Calderbank Letter Template

If you receive a settlement offer during a dispute, be careful to understand what kind of offer it is. If it is a ‘Calderbank offer’, and you reject it, you could be ordered to pay more of the other side’s legal costs if you are not successful. Senior Associate, Florian Ammer, and Law Graduate, Brendan May, review a recent decision of the Supreme Court of New South Wales that serves as a reminder of the importance of Calderbank offers. What is a Calderbank offer? A Calderbank offer is a type of settlement offer. It is made prior to judgment in a dispute. It can even be made prior to legal proceedings being commenced.

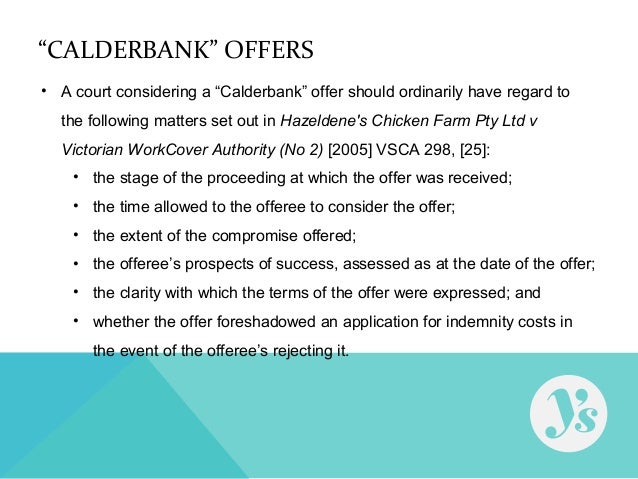

If the offer is rejected and the case proceeds to judgment, if the offering party can show that given the final result, it was unreasonable for the other party to reject their offer, it can effect who will be ordered to pay the costs of the proceeding, and how much. How does it work?

A Calderbank offer must generally be in writing. It must state that it is “without prejudice save as to costs” and that it is made pursuant to the principles established in Calderbank v Calderbank (or a statement to that effect). “Without prejudice” means that the settlement offer is without prejudice to the party’s right to initiate or continue litigation, and the letter cannot be tendered as evidence in any proceeding. The exception “save as to costs” means that if the case proceeds to judgment, the offer can be relied on in court when determining who will pay the costs of the proceeding. For example, whether the unsuccessful party should pay costs at all if they made a reasonable offer, or whether a successful party should have its costs paid on an ‘ordinary’ basis (also known as party/party costs), or an ‘indemnity’ basis (in which case all reasonably incurred costs are awarded).

Calderbank Offer

Distinction with offers of compromise Under rule 20.26 of the Uniform Civil Procedure Rules 2005 (NSW) ( UCPR), a party can make an offer of compromise, which is different to a Calderbank offer. Offers of compromise under the rules must not include an amount for costs and must not be expressed to be inclusive of costs. It was said in Whitney v Dream Developments Pty Ltd that “the use of the phrase “exclusive of costs” suggests that what is intended is that a compliant offer will not deal with costs at all”. Accordingly, while offers of compromise must not refer to costs (and are taken to be exclusive of costs), Calderbank offers may be made inclusive of costs. What happened in this case?

The recent case of Meldov Pty Ltd v Bank of Queensland (No. 2) ( Meldov No 2) provides a good example of the operation of these principles. It concerns the costs of the dispute in Meldov Pty Limited v Bank of Queensland ( Meldov No 1). Meldov No 1 involved a contest between two mortgagors, the Bank of Queensland Ltd ( BOQ) and a second mortgagor, Meldov Pty Ltd ( Meldov), over the proceeds of sale of a property. The BOQ had mistakenly advanced more money than it intended to the borrowers under an ‘all moneys’ mortgage.

Due to the mistaken advance, Meldov was seeking $150,000.00, which had been secured by a second mortgage on the property, claiming that the mistaken advance was not secured under the BOQ’s ‘all moneys’ mortgage. Meldov was wholly unsuccessful. Meldov No 2 was concerned with how much of the BOQ’s costs in Meldov No 1 would have to be paid by Meldov, the unsuccessful plaintiff. The decision was handed down on 11 June 2015. The BOQ submitted evidence that it had made a Calderbank offer to Meldov almost a year before, on 18 July 2014, where it offered Meldov $80,000 “in full and final settlement of the proceeding”.

The offer was expressed to be open for twelve days. Meldov did not accept the offer and it expired.

Settlement offers take the form of either Calderbank letters or Offers of compromise under the UCPR. Offers of compromise under the UCPR. To qualify as offer of compromise under the UCPR, offer must:.

Explicitly state that they comply with the UCPR: (3). Be exclusive of costs: r 20.26 (2). Cannot be withdrawn before the time specified: r 20.26 (11). Result: unless in the case of 'exceptional circumstances' , if a plaintiff offers a compromise which is rejected and then is awarded a higher amount than he offered by the court, he will receive from the day of the offer. Offeree has the onus of proving exceptional circumstances. Calderbank letters:. Rejected Calderbank letters do not necessarily result in indemnity costs orders - indemnity costs will be awarded only if (: SMEC v Campbelltown City Council):.

The offer contained a genuine compromise. 'Walk away' or 'trivial' offers are usually not considered genuine Offers: '; Miwa v Siantan Properties. A waiver of interest can constitute a compromise: Manly Council v Byrne (No 2). The rejection was so unreasonable to the degree that it ' warrants departure from the ordinary rule as to costs'. In determining this, relevant considerations include (: Miwa v Siantan Properties):. Promptness of the application. Whether there was sufficient time to consider?.

The extent to which the compromise was fair. Whether there was adequate information given to consider the offer?.

At what stage was the offer made? Have there been any developments since the offer was made?.

What were the prospects of success?. Whether any conditions were attached to the offer and whether they were unreasonable?. Failed Offers of Compromise will still serve as Calderbank letters:. This topic is within. Contents. Required Reading Dorne Boniface, Miiko Kumar and Michael Legg, Principles of Civil Procedure in NSW (2d ed 2012) Thomson Reuters, 14.210-14.265. Introduction Litigants are generally encouraged to reach a settlement as opposed to pursue their claims in court.

A party who unreasonably rejects a genuine settlement offer might be liable to cost consequences (usually having to pay costs on an. The two methods to offer a settlement are the UCPR offer of compromise and its common law relative, Calderbank letters. Offers of compromise are strictly governed by the UCPR, which means that the court has less discretion in issuing costs orders etc. Calderbank letters are offers to compromise which are marked 'without prejudice save as to costs'. They lack the certainty and formal structure of the UCPR offers of compromise, and involve a larger degree of judicial discretion as to costs. Of the CPA allows the court to determine whether a settlement has already been reached by the parties, and to enforce it. Offers of Compromise Offers of compromise are governed by the UCPR, which can be summarised as follows:.

A party may make an offer to another to compromise on any claim in the proceedings through a written notice: (1). However, a plaintiff may not make an offer unless the defendant has been given necessary documentation to fully consider the offer: (4). An order against the plaintiff that he failed to comply with this requirement can only be made if the defendant has informed the plaintiff in writing within 14 days that he has not been given the information, or if the court orders otherwise: (5). The notice should contain a statement to the effect that the offer complies with these rules. If there was any other interim payments or offers, it should state whether the offer is in addition to that interim payment: (3).

The offer doesn't need to relate to all the claims in the proceedings or be restricted to a money sum. More than one offer can be made: (10). The offer must be exclusive of costs, except where it states that it is a verdict for the defendant and that the parties are to bear their own costs: (2). An offer can have a time limit: (6). If it does, the following rules apply (:(7)):. If there is still 2 months or more before the trial stars, the offer has to be available for at least 28 days.

Cafe manila for windows 7 crack. If there is less than 2 months until the trial, the offer must be left open for for a 'reasonable time in the circumstances'. Unless otherwise provided, the consideration included in the offer needs to be provided within 28 days after the acceptance of the offer: (8). An offer is without prejudice, unless the notice of offer otherwise provides: (9).

Unless the court orders otherwise, an offer may not be withdrawn during the period of acceptance for the offer: (11). Offers of compromise were discussed in:. An offer which fails to comply with subsection 3 will still qualify as a 'Calderbank letter' (but not as an offer of compromise), which is still relevant in an application for indemnity costs. An offer which merely invites the plaintiff to capitulate is not a compromise offer.

Refusing such an offer is not unreasonable (if there is any reasonable prospect of success), and the refusal will not trigger the award of costs on an indemnity basis. The test is as follows: whether the offer contained a genuine element of compromise or whether it was a formally stated demand for payment or capitulation which was simply designed to trigger the payment of costs on an indemnity basis. The fact that a plaintiff does not succeed in the case does not mean that it was unreasonable not to walk away (by accepting the offer to capitulate) - if there was originally a reasonable chance of success, refusing to capitulate is not unreasonable. Calderbank Letters Calderbank letters developed from the case of Calderbank v Calderbank, which determined that confidential settlement offers ('without prejudice') can be shown to the court for the purposes of determining a costs order. Whilst initially restricted to matrimonial cases only, the principle now applies to all disputes.

The policy behind the principle is to encourage people to accept settlements (by intimidating unreasonable refusals with big costs orders). The first question regarding rejected Calderbank offers and costs order is whether the offer contained a genuine compromise - this is an evaluative judgment considering how fair the offer is. 'Walk away' offers, as was discussed above in Kain v Mobbs, are usually not considered genuine, but may do in certain circumstances. Offers which are relatively so small that they can be considered 'trivial' or 'contemptuous' also don't constitute genuine offers. A waiver of interest can constitute a compromise. The rejection of even a genuine Calderbank offer does not automatically mean that costs are awarded on an indemnity basis. Instead, the court determines whether the failure to accept the offer 'warrants departure from the ordinary rule as to costs': SMEC v Campbelltown City Council.

This can be more succinctly termed as to whether the rejection was ' unreasonable ' enough to warrant indemnity costs. In determining whether rejection was unreasonable, relevant considerations include:. Whether there was sufficient time to consider?. The extent to which the compromise was fair.

Calderbank Letter Ireland

Whether there was adequate information given to consider the offer?. At what stage was the offer made? Have there been any developments since the offer was made?. What were the prospects of success?. Whether any conditions were attached to the offer and whether they were unreasonable?.

Offer inclusive of costs still constitute Calderbank letters, but there is a danger that the court may not be able to determine whether or not it was unreasonable for the offeree to accept the offer. Calderbank offers may be 'in the alternative'. Which One to Choose? The question arises, how do you decide whether to issue an offer of compromise under the rules or a Calderbank offer:.

Offers of compromise have recently become more flexible, but they are still restricted in some ways (must state compliance with the rules, must be exclusive of costs, cannot be withdrawn before the time specified). However, their advantage is that the procedure which follows them is fairly automatic: unless in the case of 'exceptional circumstances' (. Offeree has the onus of proving exceptional circumstances), if a plaintiff offers a compromise which is rejected and then is awarded a higher amount than he offered by the court, he will receive costs on an indemnity basis from the day of the offer. The refusal of a Calderbank offer does not result in 'automatic' triggering of indemnity clause but is merely a consideration. Thus, and since the offers of compromise have become very flexible, it is usually much better to use them as opposed to Calderbank offers. In Miwa v Siantan Properties (No 2), the appellant used a Calderbank offer because they wanted the offer to be inclusive of costs:. Facts: the appellant applied for indemnity costs on the basis that a Calderbank offer was unreasonably rejected.

Held: the amount actually offered here was nominal, the main compromise was as to the quite significant costs. This meant that the offer was pretty much an invite to capitulate.

Calderbank Offer Letter Template

Refusing to capitulate is not unreasonable unless there were no reasonable prospects of success, which was not the case here. Application for indemnity costs refused. End This is the end of this topic. Click to go back to the main subject page for Resolving Civil Disputes. References BKL refers to Dorne Boniface, Miiko Kumar and Michael Legg, Principles of Civil Procedure in NSW (2d ed 2012) Thomson Reuters.

FDR refers to Michael Legg (ed), The Future of Dispute Resolution (2013) LexisNexis.